In This Expensive And Stressful Environment

I Help You To Have More Time, Money, Peace and Happiness

The cost and complexity of living comfortably in Singapore is rising at an alarming rate. I work with students, fresh graduates and their parents to optimise their financial portfolios – unlocking both time and cash flow to focus on what matters most to every unique individual. Backed by a structured advisory process and practical experience, I guide clients to make smarter choices with less stress, so they can live more intentionally and confidently.

More about Basil:

Associate Director, Resource Optimisation & Investment Professional

Basil has always had a passion for financial planning and helping those around me. Motivated by his desire to help those around him attain a higher level of financial literacy, he has met over 200 individuals to do customised planning and is currently serving over 60 clients including students, fresh graduates, their parents and pre-retirees. All of which choose him as their advisor because of the clarity, efficiency and objectivity in his structured planning processes.

Fast forward and he is one of the youngest Associate Directors around and a member of the Million Dollar Round Table representing a top strata of advisors.

Basil’s method

Basil’s key systems to provide clarity on our finances

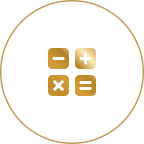

Financial Freedom Calculator

A “Financial Freedom Calculator” - to help his clients set investment goals and chart out a strategy to reach them eventually or even 5-10 years earlier

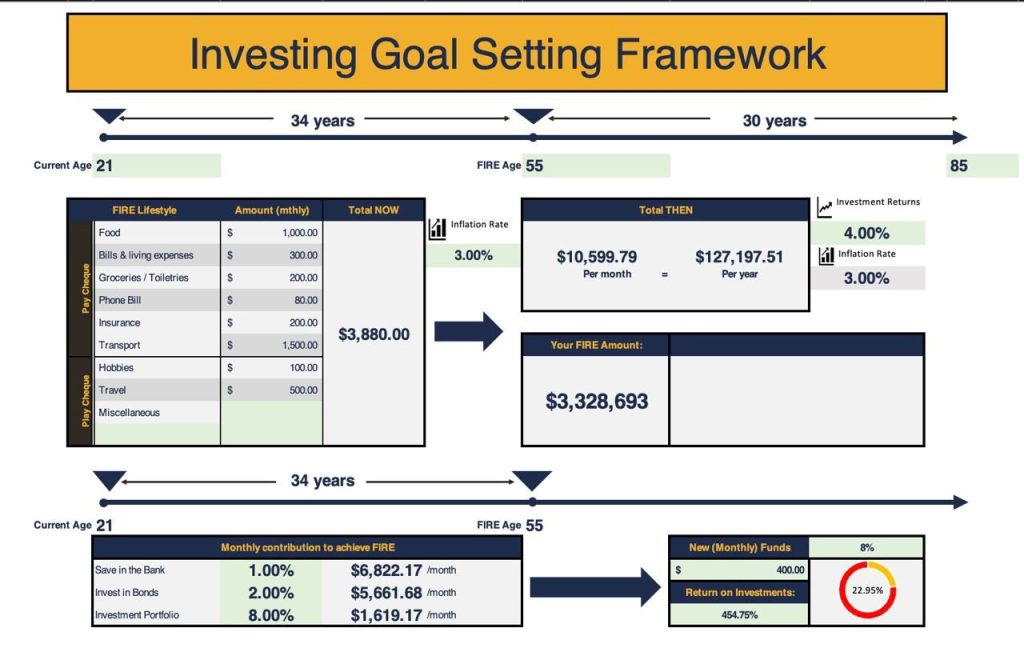

Cash Flow Analysis

An elaborate Cash Flow Analysis Excel sheet - to help his clients map out their finances in a detailed manner, to see if they are on track to reaching their goals

In just a few months, Basil has built up a team of 5 associates who hope to change the industry together and has done consultations for over 20 people, having up to 10 appointments a week.

Be productive with your money, let your wealth grow while you sleep

While we work hard ourselves, can we find ways to make our money work as well? It all starts with proper planning to secure passive income streams.

Areas of Expertise

Basil’s advisory services include Budgeting, Investment and Insurance planning for students and graduates as well as Retirement and Legacy Planning for parents. Experience next-level wealth advisory with his personalised consultation process.

Financial Advisory

To help you take ownership of your wealth and plan your financial life, setting and achieving realistic goals.

Insurance Planning

To protect what's precious. Helping you manage your wealth, making sure all your bases are covered.

Personal Investment

To live a financially free life, helping you make informed investment decisions, growing your wealth in a way that suits you.

Retirement Planning

To ensure that you live a life that outlives you, having enough at the end of time.

Mortgage Planning

To optimise your mortgage and understanding where your property fits in your financial portfolio.

Estate Planning

To ensure that your assets are passed down to your loved ones, keeping your legacy and loved ones protected.

What his client says

Basil is someone who is passionate about helping others improve their financial stability. He clarifies doubts and provides insights on various areas (like CPF and Housing Policies) to better meet the goals of his clients and I’m thankful for the insightful session we had today.

I also like that he is actually planning for my finances - looking at options that I have given my current circumstances and goals and the focus isn't on selling me anything.

Problem Solution

Managing Wealth Should Be Straightforward And Easy.

Managing our finances does not seem urgent but is best started ASAP.

Most of us might feel like our goals are too far away or are distracted by the current circumstances. Yet 90% of us think it’s important to think about it now. Basil aims to bridge the gap by streamlining your financial journey process into concise and focused sessions: to allow 1h-2h of your time to secure the next 20-30 years without worry. Procrastination is normal yet fatal and Basil aims to target that by providing a needs-based and enjoyable advisory process.

Most people know that investing is important, however many either get into investments out of the fear of missing out, resulting in unnecessary losses, or end up never getting into it due to the lack of knowledge, time or interest. This leads to a loss of potential returns. Hence Basil specialises in creating passive and strategic portfolios for individuals to invest in the market, taking into account the relevant risk appetites of his clients. Allowing them to grow their money while focusing their time on their careers and personal lives instead.

Assets Optimization

Schedule A Strategy Consultation.

In Just 30-45 Minutes, Basil will be able to help you unlock and identify unoptimized assets that you may have or gaps in your protection, to help you maximise your investment returns and ensure your goals are secured.

At the very least, you will get a better understanding of your financial position, to help you make better financial goals for your future.

Fill up the form below and he will personally schedule a call back.